The Complete Guide to Home Warranties for Homeowners

Home warranties provide valuable protection for homeowners by covering the repair and replacement costs of major home systems and appliances. Unlike homeowners insurance, which protects against external damage, a home warranty focuses on the normal wear and tear of household items. Understanding how these warranties work, what they cover, and their associated costs can help homeowners make informed decisions about protecting their investment and maintaining peace of mind.

A home warranty serves as a service contract that covers the repair or replacement of major home systems and appliances when they break down due to normal wear and tear. This protection plan has become increasingly popular among homeowners who want to avoid unexpected repair costs and ensure their household runs smoothly.

How Home Warranties Differ from Homeowners Insurance

Home warranties and homeowners insurance serve distinctly different purposes in protecting your property. Homeowners insurance covers damage from external events like fires, storms, theft, and accidents. It protects the structure of your home and personal belongings against unforeseen circumstances beyond your control.

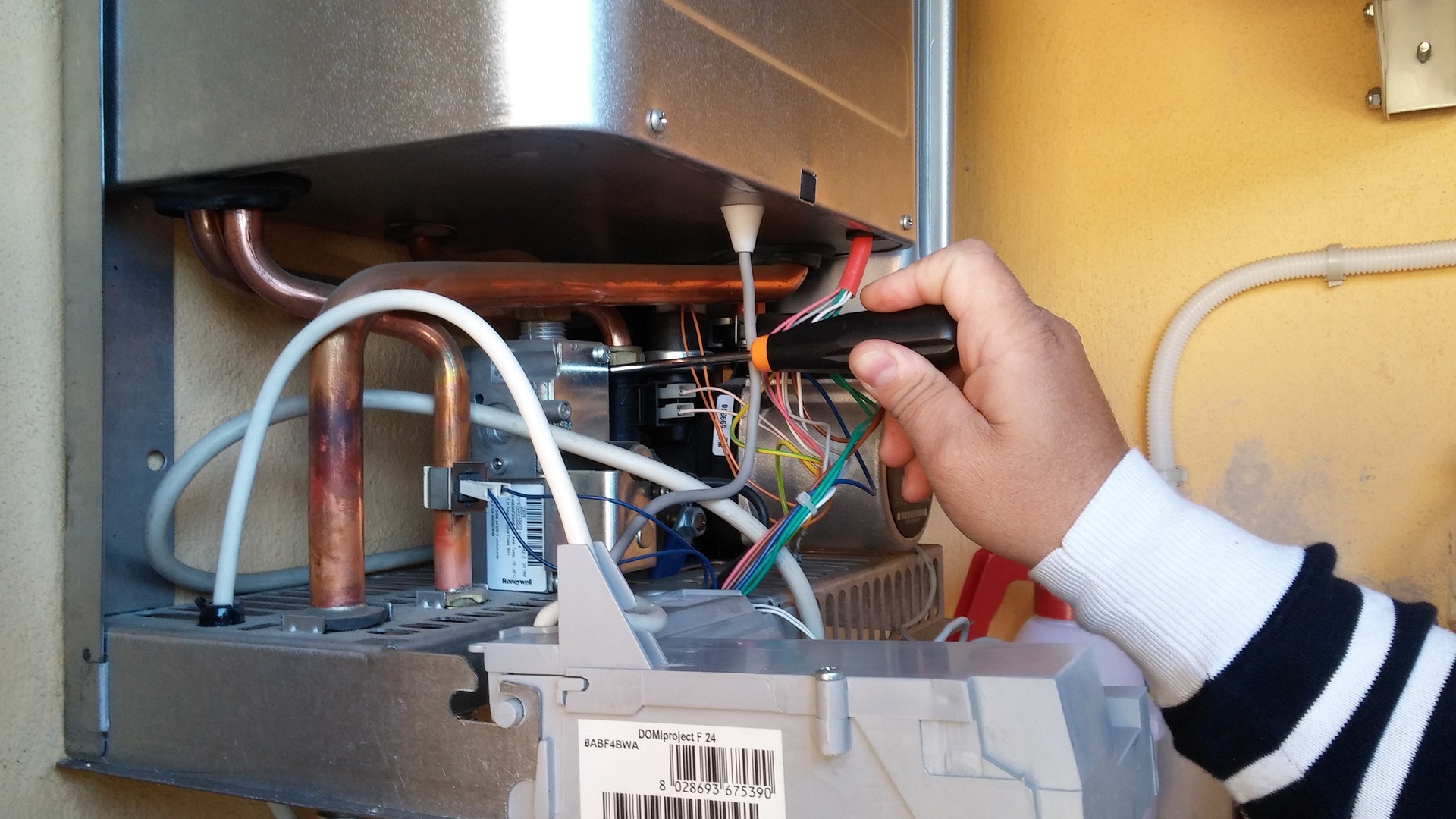

A home warranty, however, focuses specifically on the mechanical breakdown of home systems and appliances due to normal use over time. It covers items like HVAC systems, water heaters, electrical systems, plumbing, and major appliances such as refrigerators, dishwashers, and washing machines. While insurance handles catastrophic events, warranties address the inevitable aging and failure of household equipment.

Understanding How Home Warranties Work

When a covered item breaks down, homeowners contact their warranty company to request service. The company dispatches a pre-approved contractor to diagnose and repair the problem. Homeowners typically pay a service call fee, which ranges from $75 to $125, regardless of the repair cost.

The warranty company covers repair costs up to the coverage limits specified in the contract. If an item cannot be repaired, the company may replace it with a comparable model. Most warranties operate on an annual contract basis, with coverage beginning after a waiting period of 30 days for existing appliances.

Peace of Mind and Financial Protection Benefits

Home warranties provide significant peace of mind by eliminating the stress of finding reliable contractors and managing unexpected repair costs. When your air conditioning system fails during summer or your water heater stops working, you have immediate access to professional service without researching contractors or worrying about inflated emergency rates.

The financial protection aspect proves particularly valuable for homeowners on fixed budgets. Major appliance repairs can cost hundreds or thousands of dollars, while system replacements may require even larger investments. A home warranty transforms these unpredictable expenses into manageable annual premiums and small service fees.

Coverage Options and Limitations

Most home warranty companies offer different coverage levels, from basic plans covering essential systems to comprehensive packages including appliances and additional items. Basic plans typically cover HVAC, electrical, and plumbing systems, while upgraded plans add kitchen appliances, washers, dryers, and specialty items like pools or well pumps.

However, warranties come with limitations and exclusions. Pre-existing conditions, improper maintenance, and items beyond their useful life may not be covered. Coverage caps limit the maximum amount the company will spend on repairs or replacements, and some warranties exclude certain brands or older appliances.

Cost Analysis and Provider Comparison

Home warranty costs vary based on coverage level, location, and provider. Understanding these costs helps homeowners evaluate whether a warranty provides good value for their specific situation.

| Provider | Basic Plan Cost | Comprehensive Plan Cost | Service Fee |

|---|---|---|---|

| American Home Shield | $420-$600/year | $600-$840/year | $75-$125 |

| Choice Home Warranty | $350-$500/year | $550-$750/year | $75-$100 |

| Select Home Warranty | $400-$550/year | $650-$850/year | $85-$125 |

| Total Home Protection | $380-$520/year | $580-$780/year | $75-$115 |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Making an Informed Decision

Before purchasing a home warranty, homeowners should assess their current appliances’ age and condition, evaluate their financial situation, and research potential providers thoroughly. Reading contract terms carefully, understanding exclusions, and checking customer reviews help ensure you select appropriate coverage.

Consider factors like your home’s age, appliance reliability, local contractor availability, and your comfort level with unexpected repair costs. Newer homes with appliances under manufacturer warranties may benefit less from home warranties, while older homes with aging systems often find significant value in coverage.

Home warranties can provide valuable protection and peace of mind for many homeowners, particularly those with older appliances and systems. By understanding how warranties differ from insurance, knowing what coverage options exist, and carefully evaluating costs and benefits, homeowners can make informed decisions about whether this protection fits their needs and budget.